RJ Hamster

RJ Hamster

The “Warsh Shock” that just vaporized billions in precious…

February 03, 2026

If you own gold or silver, you probably had a very bad Friday.

In less than 24 hours, precious metals experienced what traders are calling their “most aggressive one-day sell-off in years.” Gold plummeted. Silver cratered. And the culprit? A single presidential announcement that most people would consider… good news.

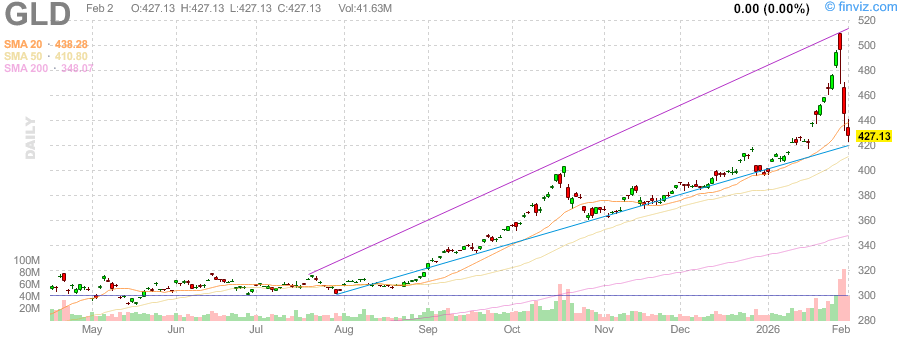

Gold’s sudden crash caught traders off guard:

Silver followed with a sharp sell-off:

President Trump nominated Kevin Warsh to lead the Federal Reserve.

On paper, this should’ve been boring. Fed appointments are typically wonky affairs that make eyes glaze over. But this one triggered what markets are now calling the “Warsh Shock” – a violent reversal that left precious metals investors reeling and revealed something fascinating about market psychology.

Here’s the twist: Markets crashed precious metals because they LIKED Trump’s choice.

Why “Good News” Triggered a Panic

For months, gold and silver had been climbing on what analysts call “debasement fears.” Investors worried Trump might appoint a Fed chair who would be a complete pushover – someone who’d print money recklessly and devalue the dollar into oblivion.

Gold bugs were betting on chaos. They stockpiled precious metals as insurance against potential monetary mayhem.

Then Trump picked Kevin Warsh.

A New Nasdaq AI Listing Is Flying Under the Radar

Something unusual just happened on Nasdaq.

A company quietly went public — but it’s not software, chatbots, or cloud AI.

VenHub Global is building fully autonomous retail stores powered by AI, robotics, and automation. Customers order on their phone while robotic systems handle fulfillment, and the store never closes.

This isn’t a concept.

Live deployments are already operating in Los Angeles transportation hubs, with more rollouts planned.

Early Nasdaq listings tied to new categories rarely stay quiet for long.

👉 Get the full breakdown here.

Alert Disclaimer

Warsh isn’t some random political appointee. He’s a former Fed governor with deep central banking experience. More importantly, he’s known as an “inflation hawk” – someone who takes price stability seriously. As Susannah Streeter from Wealth Club put it: “He’s not expected to be a pushover.”

The market’s message was clear: If Warsh is running the Fed, we don’t need to panic about currency debasement anymore.

But here’s where it gets interesting…

The Reverse Psychology of Safe Havens

This crash reveals a counterintuitive truth about “safe haven” assets: Sometimes they’re most dangerous when everything seems safest.

Think about it. Gold and silver didn’t crash because of bad economic news. They crashed because of GOOD news. The better Trump’s Fed choice looked to institutional investors, the worse it got for precious metals holders.

This is the paradox of crisis investing. When people expect chaos, they bid up insurance. When chaos fears evaporate, that “insurance” becomes worthless overnight.

The dollar strengthened. Stocks rallied. And billions of dollars in precious metals wealth simply… vanished.

Time to kiss options goodbye?

You see, the options market is commonly known as a way to milk a tiny stock move for all it’s got.

But not only has it come with a lot more hassle, but it’s also brought significantly more risk!

However, thanks to a powerful new vehicle that helps “track what hedge funds are hiding deep in the dark pool…

What This Means for Your Money

This event highlights three crucial lessons every investor needs to understand:

First: Narrative drives markets more than fundamentals. The story investors tell themselves about what’s coming next matters more than what’s actually happening today.

Second: Contrarian thinking pays. When everyone’s preparing for one outcome (monetary chaos), the opposite outcome (monetary stability) can be more profitable.

Third: “Safe haven” assets aren’t always safe. They’re only safe when people believe they need safety. Change the narrative, and safety becomes risk.

The Warsh nomination did more than just move markets – it revealed how much recent precious metals gains were built on fear rather than fundamentals.

But Here’s What Nobody’s Talking About…

While everyone focuses on the crash, smart money is asking a different question: What happens when this initial shock wears off?

One of the most effective stock metrics for day traders

This is 4 decades of trading experience distilled into 7 easy-to-consume pages.

Inside, you’ll also find 23 Golden Rules for day trading, including:

- How to quickly spot quality stocks already going up

- The specific trade setup that’s resulted in a shocking 94.2% win rate

- How to avoid cutting winners too early

- And much, much more!

So head over here now and get yourself a FREE copy.

Warsh may be credible, but he still inherits a complex economic environment. Inflation pressures. Geopolitical tensions. Market instability. The very challenges that made investors seek safe havens haven’t disappeared – they’ve just been temporarily overshadowed by Fed appointment relief.

Which raises the question: Was Friday’s precious metals crash an overreaction? Or the beginning of something bigger?

The answer might surprise you. Because while markets celebrated Warsh’s nomination, they may have missed something crucial about what his appointment actually signals for the months ahead…

Tomorrow: We’ll explore what Kevin Warsh’s past statements reveal about his true policy intentions – and why his nomination might not be as “safe” for markets as everyone thinks.

Update your email preferences or unsubscribe here

© 2026 Stable Financial Publications

1013 Centre Road Suite 403-D

Wilmington, DE 19805, United StatesTerms of Service