RJ Hamster

RJ Hamster

CPI inflation cools more than expected — and Apple…

February 13, 2026

OPENING THESIS

The January CPI report landed this morning with a surprise to the downside: core inflation at 2.5% year-over-year, with the headline print cooling more than economists expected. Markets should be celebrating. Instead, Apple is down 5% on reports that its AI-powered Siri upgrade has hit serious technical delays — and the broader market cannot decide whether to focus on the good news or the bad.

MARKET OVERVIEW

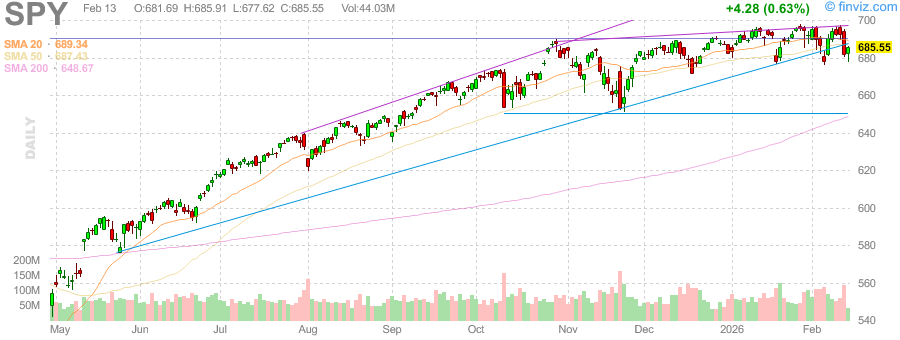

The S&P 500 opened essentially flat at 6,832 after yesterday’s sharp selloff. The Nasdaq slipped 0.16% to 23,066 as tech rotation continues. The Dow edged lower to 50,121.

The CPI print is the story. More than half of traders are now pricing in a 25-basis-point rate cut by June, with most bets centered on two cuts by year-end. The 10-year Treasury yield drifted to 4.12% on the news — a relief valve for rate-sensitive sectors.

But the inflation data arrived into a market already rattled by a week of AI capital expenditure anxiety. The question investors are asking: is the AI infrastructure buildout sustainable, or are we seeing the early stages of a spending hangover?

Investor Signal: Cool inflation plus rate cut expectations should be bullish. The market’s hesitation tells you positioning is more cautious than headlines suggest.

$1,000 into $556,454. Impossible?

I want to show you something that might make you upset.

For decades, the biggest banks in America have been using a secret account to collect an average of 29% per year — without ever telling the public.

Since 2000, this single account has turned $1,000 into over $556,454.

Not by picking stocks or timing the market. Just by parking money in an account that’s averaged 29% year after year.

The big banks knew about it. You didn’t.

That changes today.

👉 Click here to see how “The 29% Account” works.

DEEP DIVE

Apple’s AI Problem Is Bigger Than One Day

Apple shares dropped 5% this morning — the stock’s worst single-day decline since April 2025. The catalyst: reports that the long-anticipated AI-driven Siri upgrade has encountered technical problems that could delay key features.

This matters beyond Apple’s stock price. The company represents the consumer-facing promise of artificial intelligence. If Apple cannot deliver a compelling AI experience to its 1.2 billion active device users, it raises questions about the entire AI monetization thesis.

Meanwhile, the semiconductor supply chain tells a different story. Applied Materials surged 11% on blowout earnings and an upbeat outlook. Arista Networks jumped 10% on surging demand for AI networking infrastructure. The hardware companies building AI’s backbone are thriving even as the software companies promising AI features stumble.

This divergence — hardware winners, software laggards — could define the next phase of the AI trade. Companies selling picks and shovels are printing money. Companies promising AI gold are finding the mine harder to dig than advertised.

Nvidia led the Magnificent Seven with a 0.6% premarket gain, confirming its position as the infrastructure play of choice. Microsoft and Alphabet opened with modest gains, suggesting the market still believes in their AI strategies, if cautiously.

Investor Signal: The AI trade is splitting into haves and have-nots. Hardware infrastructure remains the higher-conviction bet.

WHAT IT MEANS

The CPI print removes the worst-case scenario from the table. Inflation is not reaccelerating. The Fed has room to maneuver. That is unambiguously positive for equity valuations.

But the market’s muted response reveals something important: investors are more focused on earnings quality and AI execution than macro data right now. The rotation from momentum to fundamentals is accelerating.

Rivian’s 16% surge on strong delivery guidance shows the market will reward companies that execute. Pinterest’s 14% collapse on weak guidance shows the punishment for missing expectations is severe. This is a stock picker’s market, not a rising-tide environment.

Investor Signal: In a market that ignores good macro data, individual company execution becomes the only thing that matters.

Smart Money Is Accumulating This Altcoin for the Trump Bull Run

The market is down and fear is everywhere — but big institutions aren’t slowing down.

BlackRock is buying. Fidelity is building. Major players are still positioning for what’s coming next.

Behind the scenes, insiders are quietly loading up on one altcoinplaying a critical role in a fast-growing crypto ecosystem — similar to early Uniswap before it took off.

With Trump’s pro-crypto policies beginning to take effect and a bull run approaching, this coin could be set up for major upside.

👉 See the #1 altcoin smart money is buying now.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

SECTOR SPOTLIGHT

The Semiconductor Surge

Applied Materials and Arista Networks delivered earnings that silenced the AI skeptics — at least on the hardware side. AMAT’s 11% jump represents a massive endorsement of continued semiconductor equipment spending.

The message from these results is clear: whatever happens with consumer AI applications, the infrastructure buildout continues. Data centers need chips. Chips need equipment. Equipment makers are booked solid.

This creates a clear investment hierarchy in the AI ecosystem: infrastructure first, platforms second, applications last. The picks-and-shovels thesis that worked in every prior technology wave is working again.

[How To] Claim Your Pre-IPO Stake In SpaceX!

This is urgent, so I’ll be direct…

For the first time ever, James Altucher – one of America’s top venture capitalists – is sharing how ANYONE can get a pre-IPO stake in SpaceX… with as little as $100!

In other words, this is your first-ever chance to skip the line, and get in BEFORE Elon Musk’s next IPO takes place.

Best of all, it couldn’t be any easier…

When you act today, you can get a pre-IPO stake right inside your regular brokerage account, all with just $100 and a few minutes of time.

All you need is the name and ticker symbol that James reveals for FREE, right inside this short video.

CLOSING LENS

Friday the 13th is delivering a split personality market. Inflation cooperating. Apple stumbling. Semiconductors surging. Rivian surprising everyone.

The CPI data confirms what gold at $5,000 has been whispering: the Fed’s next move is a cut, not a hike. The only question is timing. June odds just improved meaningfully.

But the AI narrative is fracturing. The era of “buy anything with AI in the name” is over. Replaced by something harder but ultimately healthier: prove it works, show the revenue, deliver the product.

Apple’s 5% drop on an AI delay would have been unthinkable a year ago. Today it is a warning: execution risk in artificial intelligence is real, even for the world’s most valuable company.

The market is growing up about AI. That is not bearish — it is necessary. The companies that survive this scrutiny will be the ones worth owning for the next decade.

Position for selectivity, not sentiment. The data is your friend today. Your portfolio should reflect that.

Update your email preferences or unsubscribe here

© 2026 Stable Financial Publications

1013 Centre Road Suite 403-D

Wilmington, DE 19805, United StatesTerms of Service