RJ Hamster

RJ Hamster

Amazon’s Spending Shock | Dow Hits 50K | Fed…

February 08, 2026

OPENING THESIS

The market just delivered a masterclass in how spending announcements can reward some companies while punishing others.

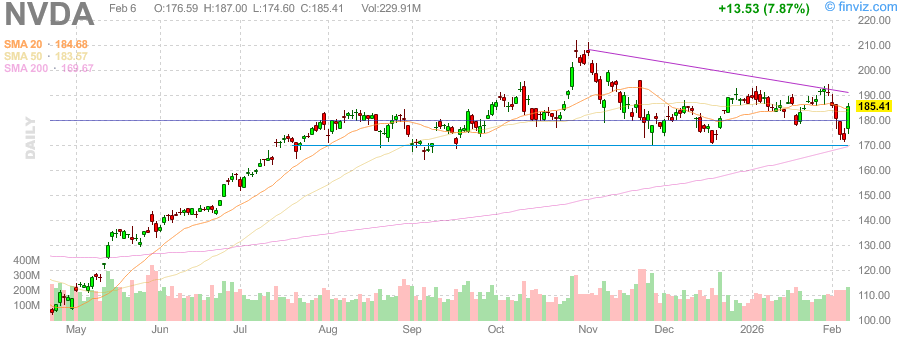

While Nvidia surged 8% and the Dow crossed 50,000, Amazon tumbled 7% after outlining massive 2026 capex plans.

The difference?

Timing, expectations, and which side of the AI arms race you’re funding.

Nvidia daily chart showing 8% surge

MARKET OVERVIEW

The Recovery That Proved the Point

The S&P 500 jumped 1.97% to 6,932.30, climbing back into positive territory for 2026. The Nasdaq advanced 2.18% to 23,031.21.

This wasn’t just any bounce. It was a systematic reversal after markets had wiped out roughly $1 trillion in market capitalization.

The Dow’s historic milestone above 50,000 became the headline, but the real story was underneath. Selective buying, not broad euphoria.

Investor Signal: The market is rewarding companies that can execute on AI spending, not just announce it.

The Greatest Stock Story Ever?

I had to share this today.

A strange new “wonder material”just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

DEEP DIVE

Amazon’s $7 Billion Problem

Amazon daily chart showing 7% decline

Amazon plunged 7% despite strong earnings after outlining plans for a massive 2026 spending increase. The culprit: cloud infrastructure capex that promises returns years down the road.

Compare this to Nvidia, which surged over 8% on the same day. Same AI theme, opposite market reaction.

The difference is simple: Nvidia sells picks and shovels during a gold rush. Amazon is digging holes and asking investors to trust the eventual payoff.

Wall Street has seen this movie before with tech capex cycles. The companies that spend early often create the most value long-term, but they get punished short-term.

Tesla and Broadcom also posted sizable gains, suggesting investors are separating execution stories from spending stories.

Investor Signal: The AI spending playbook is getting more sophisticated – markets reward revenue enablers, punish cost accumulators.

WHAT IT MEANS

The Fed’s Dovish Surprise

Market expectations for Fed rate cuts ticked up this week after a relatively dovish FOMC meeting. Powell noted the most likely next move remains a cut, but only after tariff inflation effects prove temporary.

The Fed is well-positioned to remain on hold through the first half of 2026 at least. But markets are pricing in more optimism than that.

This creates an interesting setup: stocks rising on rate cut hopes while the Fed signals patience. Eventually, one side adjusts.

The recent market volatility suggests institutions are using any Fed dovishness as an opportunity to rotate positions, not add risk.

Investor Signal: Rate cut optimism is providing cover for tactical repositioning, not driving fundamental demand.

The Fed Didn’t Cut — And Crypto’s Next Move Is Setting Up

The Fed just held rates steady, and in crypto, that often marks the start of major positioning before liquidity flows back in.

These macro transitions have kicked off some of the biggest runs in past cycles. But the real gains don’t go to every coin — they go to projects with real adoption, strong fundamentals, and infrastructure institutions are already using.

One coin is flashing those signals right now and still trades at a steep discount.

👉 Get the full breakdown before the window closes.

SECTOR SPOTLIGHT

The Software Selloff Reversal

Tech rebounded after major software stock selloffs earlier this week. The pattern was classic: indiscriminate selling followed by selective buying.

Software companies with clear AI monetization stories led the recovery. Those still promising future benefits lagged.

This mirrors the broader AI spending narrative playing out across the market. Execution matters more than vision in the current environment.

The recovery in tech suggests the selloff was more about position management than fundamental deterioration.

Investor Signal: Software is stabilizing along AI monetization lines – immediate revenue impact trumps long-term potential.

The AI Stock 6 Tech Giants Are Buying

Twenty years ago, $7,000 spread across the original Magnificent Seven could be worth $1.18 million today.

Now, the famous investor who called 4 of the best performing stocks of the last 20 years says:

“Forget those old stocks. I’ve found the NEXT seven.“

And one of them recently pulled off something insane…

Apple, Nvidia, Google, Intel, Samsung and AMD have ALL bought shares of this company.

The same analyst who found Nvidia at $1.10 (split-adjusted) is now revealing the details — including all seven stocks he believes could lead the next AI wave.

👉 See the full breakdown here.

CLOSING LENS

Data/technology servers image

Markets don’t care about your spending plans. They care about your earning plans.

Amazon learned this the hard way. Nvidia proved it the profitable way.

The same dollar invested in AI infrastructure gets different market reactions depending on how quickly it translates to revenue. This is not short-sightedness. It’s risk management.

Companies that spend big early often create the most long-term value. But they also carry the most execution risk. Markets price that risk accordingly.

The Dow crossing 50,000 was the headline. The real story was which companies got rewarded for their spending strategies and which got punished.

This pattern will repeat throughout 2026 as more companies outline their AI capex plans. The market will separate the revenue enablers from the cost accumulators.

Position accordingly. The market is teaching us how to think about AI spending. Listen to the lesson.

Update your email preferences or unsubscribe here

© 2026 Stable Financial Publications

1013 Centre Road Suite 403-D

Wilmington, DE 19805, United StatesTerms of Service